VIX Surges: Economic Data Disruption and What It Means

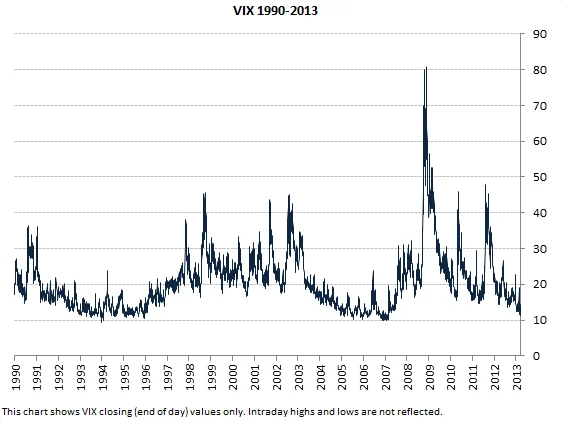

Okay, folks, buckle up. I know the headlines are screaming "market slump" and "economic uncertainty," and yeah, I saw that the S&P 500 ETF (SPY) and the Nasdaq 100 ETF (QQQ) both took a hit, closing down over 1.5%. I get it. Red numbers aren't exactly a recipe for a good mood. The VIX surging 15%? CNN's Fear and Greed Index plunging into "extreme fear" territory? Believe me, I see it.

But here's the thing: I refuse to let short-term jitters cloud my long-term vision. And you shouldn't either.

This isn't about ignoring the data. It's about understanding the context behind it. We're in a post-shutdown world, and the delayed economic reports – the missing CPI, the jobless claims – they're creating a fog of uncertainty. White House Press Secretary Karoline Leavitt even suggested the Democrats may have "permanently damaged the federal statistical system." Seriously? That’s quite the statement!

The Real Story Isn't the Slump, It's the Resilience

Let's be real: markets hate uncertainty. But uncertainty is temporary. Human ingenuity? That’s permanent. That’s the engine that drives us forward, the force that turns challenges into opportunities.

Think about it: every major technological leap throughout history has been met with skepticism, fear, even outright hostility. The printing press? People worried it would spread misinformation and destroy the established order. The internet? A passing fad, they said! And now? We can't imagine life without them.

This market dip, this “economic disruption,” is just noise. It’s the static before the signal. It’s the growing pains of a world constantly reinventing itself. It’s like when you’re coding a complex algorithm—you hit roadblocks, you debug, you iterate, and then, BAM! You get that beautiful, elegant solution.

The Fed's in a tough spot, no question. They’re trying to balance inflation – which, by the way, last registered at 3%, which is still above their target – with supporting maximum employment. Higher rates fight inflation, but they can also slow down the economy. It's a delicate dance, and as Nick Timiraos at the Wall Street Journal pointed out, several Fed presidents aren't exactly clamoring for a December rate cut. The odds of that happening are dropping like a stone, according to CME's FedWatch tool.

But here’s what gives me hope: the Fed cares about maximum employment. They’re actively trying to figure out the best path forward. And that's HUGE.

And let's not forget the human element. I saw that Challenger, Gray & Christmas reported 153,074 job cuts in October – the highest total for the month since 2003. Yeah, that stings. But those job cuts? They’re often a sign of companies restructuring, streamlining, and preparing for the future. They're making way for innovation, for new roles, for industries we can’t even imagine yet.

Think about the seismic shifts we're seeing in AI, in biotech, in sustainable energy. These aren't just buzzwords; they're fundamental transformations that are reshaping our world. When I first started seeing the breakthroughs in material sciences, I honestly just sat back in my chair, speechless.

What does all this mean? It means that the current market volatility is a blip on the radar compared to the incredible potential that lies ahead. It means that human ingenuity is our greatest asset, our most powerful tool for navigating uncertainty and building a brighter future.

And speaking of the future, I also saw that ViX, TelevisaUnivision's streaming platform, is premiering "Bajo un volcán," a movie starring William Levy. Sure, it’s just entertainment, but think about it: even amidst stories of natural disasters, we're drawn to tales of human connection and resilience. Maybe that’s a metaphor for the markets too? You can read more about the ViX premiere of "Bajo un volcán" here.

The Future Belongs to the Optimists

Look, I’m not saying everything is sunshine and roses. There are challenges ahead, absolutely. But I firmly believe that we have the capacity to overcome them. We have the creativity, the drive, and the sheer will to build a better world. So, don't let the headlines scare you. Stay focused on the long game, invest in innovation, and never underestimate the power of human ingenuity. Because that, my friends, is the real story.