Halda Therapeutics Acquired by J&J: What Happened?

Johnson & Johnson is dropping a cool $3.05 billion on Halda Therapeutics. That's the headline. But let's dig into what J&J is really buying, and whether this is a strategic investment or a high-stakes gamble.

The Allure of RIPTAC™

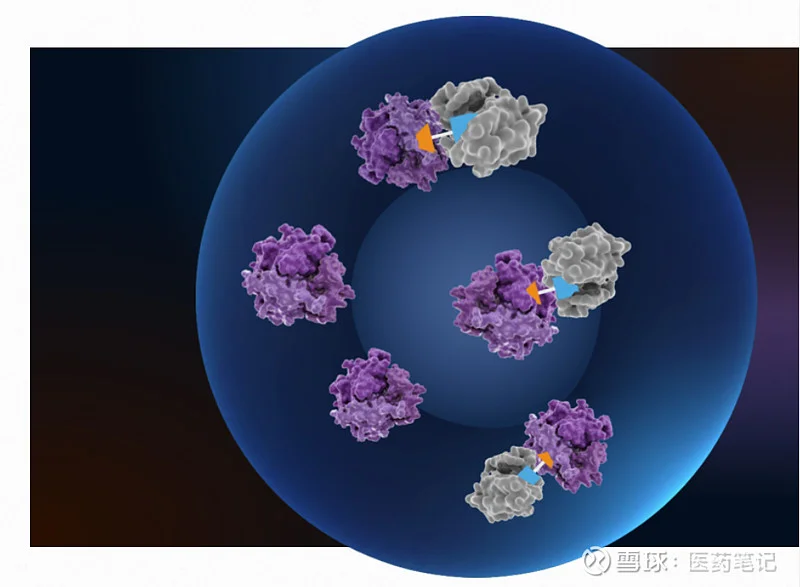

Halda’s big claim to fame is their RIPTAC™ (Regulated Induced Proximity Targeting Chimeras) platform. Sounds fancy, right? Essentially, it’s a "hold and kill" mechanism designed to get around cancer's nasty habit of evolving resistance. Their lead drug, HLD-0915, targets prostate cancer by forcing together two proteins (AR and BRD4), which then (in theory) selectively kills cancer cells.

The press release is full of buzzwords like "first-in-class" and "novel mechanism." But what about the data? Halda presented Phase 1/2 data showing HLD-0915 was "well-tolerated" and showed "encouraging signs of anti-tumor activity" in patients with advanced prostate cancer. Okay, but "encouraging" isn't exactly a home run. We're talking about reductions in PSA (prostate-specific antigen) and some responses per RECIST (Response Evaluation Criteria in Solid Tumors). That's something, sure, but it's Phase 1/2 data. The road to FDA approval is paved with failed Phase 3 trials.

And here's the part of the data I find genuinely puzzling. The release states that anti-tumor activity was "observed at all doses." That's unusual. Typically, you see a dose-response relationship – more drug, more effect. The fact that they saw activity at all doses raises questions about the mechanism and potency. Was it a real effect, or just statistical noise? Is the efficacy ceiling low?

The Price Tag: Justified or Inflated?

$3.05 billion is a hefty sum, especially for a company with a lead drug still in Phase 1/2 trials. J&J's Jennifer Taubert claims this acquisition "further strengthens our deep oncology pipeline." Perhaps. But let's consider the opportunity cost. What else could J&J have done with that $3.05 billion? They could have acquired multiple smaller companies with assets further along in development, or invested in internal R&D. News of the acquisition was announced in November of 2025. Halda Therapeutics Announces Acquisition by Johnson & Johnson

J&J is anticipating a dilution in 2026 of $0.15 to Adjusted Earnings Per Share. That is not insignificant. It tells us they are not expecting this acquisition to bear fruit quickly. They are playing the long game. But will that game pay off?

Halda was founded in 2019 and has been funded by a consortium of venture capital firms: Canaan Partners, Access Biotechnology, Deep Track Capital, Frazier Life Sciences, RA Capital Management, Vida Ventures, Boxer Capital and Taiho Ventures. That's a long list of sophisticated investors who clearly saw potential. But it also suggests that Halda may have needed a lot of capital to get to this point (and that these investors were ready to cash out).

One potential justification for the price is the RIPTAC™ platform itself. The deal includes earlier-stage candidates for breast, lung, and other tumor types. The idea is that this platform could be a source of future blockbuster drugs. But platform technologies are notoriously difficult to translate into successful products. Many promising platforms have ended up as expensive dead ends.

So, What's the Real Story?

J&J is betting big on a novel technology with limited clinical data. It's a high-risk, high-reward move. They're essentially buying a lottery ticket – a ticket with a potential payout in the billions, but also a very real chance of being worthless. Whether it pays off remains to be seen, but for now, it's a fascinating gamble to watch.